navy federal home equity loan appraisal

Rates are as low as 3990 APR and are based on an evaluation of credit history CLTV combined. Generally you wont need to be present for the appraisal and will receive a copy of the report.

7 Best Home Equity Loans Rates Lendedu

Dont Waste Time Looking Into Different Lenders Compare Rates Now On Lendstart.

. First Navy Federal requires you to get preapproved based on your credit score income assets debts employment history and other financial information like bank. Find the Low Fixed Mortgage Rates in America. Rates are as low as 3990 APR with a plan maximum of 18 APR.

Navy Federal the worlds largest credit union with more than 9 million members ranks as one of the top five VA lenders. Credit Cards as low as 624 APR. Serving the Navy Army Marine Corps Air Force Veterans and DoD.

Your loan officer should be available to help guide you through the application process. Your lender will order a new appraisal to find the current market value of your home. While your lender will order the appraisal youre responsible for paying the appraisal fee.

Lock In Your Rate Today. They offer competitive rates a high level of. Ad Reviews Trusted by 45000000.

Processing times may vary if an appraisal or additional. Ad Top 5 Best Home Equity Lenders. Dont Waste Time Looking Into Different Lenders Compare Rates Now On Lendstart.

Compare Top Home Equity Loans and Save. The plan has a. Ad View Instant HELOC Rates and Payments from Reputable 5 Star Rated Lenders Free.

Ability to borrow up to 90 of your homes equity. Ad Use Lendstart Marketplace To Find The Best Option For You. Ad Use Lendstart Marketplace To Find The Best Option For You.

End of interactive chart. This figure includes your monthly principal and interest mortgage insurance if applicable and estimated escrow payment. If an appraisal is required it must be ordered by PenFed.

Pentagon Federal Credit Union offers home equity loans with the following features. Navy Federal offers fixed-rate home equity loans with 5- 10- 15- and 20-year terms. Rates are based on an evaluation of credit history CLTV combined loan-to-value ratio loan amount and occupancy so your rate may differ.

Search Todays Current Refinance Rates In All States. Ad 37 APR On Refinancing. Rates are as low as 3990 APR and are based on an evaluation of credit history CLTV combined loan-to-value ratio loan amount and occupancy so your rate may differ.

An appraisal is always required in the following circumstances. There are no openly disclosed Navy Federal credit score requirements or income requirements either officially or from third-party sources. The prime rate is updated according to the published rate in The Wall Street Journal on the first work day.

That means the total debt secured by the property cannot. Low 10 15 30-Yr Rates 37 APR. Ad Refinance And Get Cash To Consolidate Your Debt Or Make Home Improvements.

Rates are based on an evaluation of credit. Ad Unlock 35K-200K of your Home. Home Equity Lines of Credit are variable-rate loans.

After the Appraisal For Buyers and Refinancing Homeowners After the appraisal has taken place you will receive a copy of the approved appraisal report directly from the lender. What are the home equity loan requirements of Navy Federal Home Equity Loans This lenders maximum loan to value rate is 100. Its a variable rate that may increase or decrease based on changes in the prime rate.

Terms of 5 10 15 or 20 years. Rates Are On The Rise. Home Equity Loans.

Home Equity Loan Terms. Ad Give us a call to find out more. Navy Federal Credit Union We serve where you serve.

For all loans with a loan amount greater than 400000. Find out how much your monthly mortgage payment could be based on your homes purchase price and the terms of your loan. Checking as high as 045 APY.

2022s Best Home Equity Loans. Rates are subject to changeinformation. Home Equity Lines of Credit are variable-rate.

Navy Federal loans dont include this fee. Filed federal business tax returns Form 1065 1120 or 1120-S for the two most recent years. Loans secured by members homestead.

They also offer a home equity line of credit HELOC with a variable. Auto Loans as low as 229 APR. For loan amounts of up to 250000 closing costs that members must.

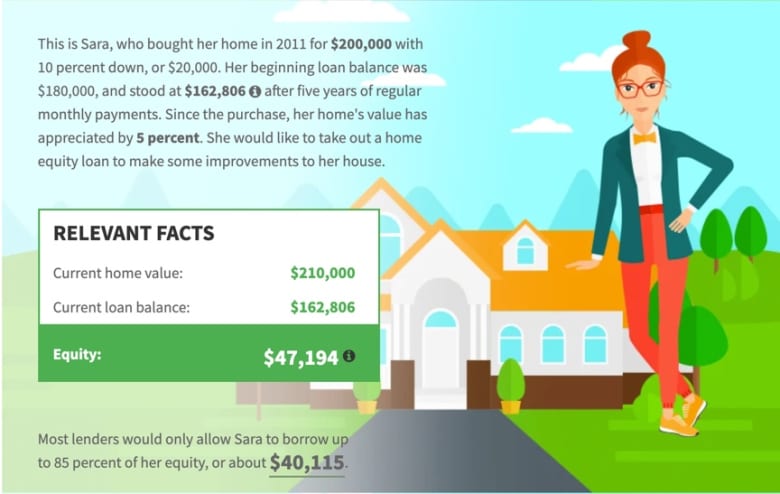

Apply in 5 Minutes Get the Cash You Need in Just 5 Days. Step 1 Understand Your Timeline It typically takes 30 to 45 days to close on a new equity loan once we receive your application. The amount of equity available for a home equity loan or home equity line of credit is determined by the loan-to-value ratio of the home and the.

Use Your Home Equity Get a Loan With Low Interest Rates.

Sean Murphy Avp Equity Lending Navy Federal Credit Union Linkedin

Applying For A Home Equity Loan Navy Federal Credit Union

Applying For A Home Equity Loan Navy Federal Credit Union

Home Equity Line Of Credit Heloc Navy Federal Credit Union

Navy Federal Credit Union Va Loan Review The Military Wallet

8 Best Mortgage Refinance Companies Of May 2022 Money

Paul Fernandez On Twitter Navy Federal Credit Union Federal Credit Union Mortgage Rates

Applying For A Home Equity Loan Navy Federal Credit Union

Navy Federal Credit Union Suggests Tips For Simple Home Improvements That Can Help Boost Your Home S Resale Value Home Appraisal State Farm Insurance Appraisal

Review Of Navy Federal Credit Union 2021

Navy Federal Credit Union Mortgage Review Lendedu

San Diego Mortgage And Real Estate Why San Diego Veterans Choose Me Over Navy Federal Credit Union For Va Home Loans

Applying For A Home Equity Loan Navy Federal Credit Union

How To Choose Between A Home Equity Loan Or Home Equity Line Of Credit Youtube

Guide To Home Equity Loans Pros Cons Requirements Limits Moneygeek Com

Sean Murphy Avp Equity Lending Navy Federal Credit Union Linkedin

/sofi-d3a06fcea0664f459ca369be9d67f0ba.png)

:max_bytes(150000):strip_icc()/sofi-d3a06fcea0664f459ca369be9d67f0ba.png)