buying a car in new hampshire to avoid sales tax

Of those states the most frugal sales tax is levied by Alabama at 2 percent. Sales taxes on cars are often hefty so you may try to avoid paying them.

The Supreme Court S Online Sales Tax Ruling Is Already A Huge Headache For Small Businesses

The most straightforward way is to buy a car in a state with no sales taxes and register the vehicle there.

. Lets continue to some other options. You need to come back to NH get. However if you still cant find what youre looking for check out the most commonly asked questions below.

Can I buy a car in Oregon and not pay sales tax. It can be tempting to try to buy a car in a state with no sales tax like New Hampshire then transport it back to your home state. So if you live in Massachusetts a state that has sales tax but buy a car in New Hampshire a state with no sales tax you will still have to pay tax to your home state of Massachusetts when you go to.

Buying and Selling FAQs in New Hampshire. If you are buying a car in another state make sure the dealer fills out paperwork for Oregon residents so that you do not have to pay sales tax. Gallatin County collects a 05 percent local option vehicle.

Ad All Remaining 2021 Models Must Go. Where You Register the Vehicle. This strategy is straightforward and simple in some.

Im going to purchase a vehicle from an individual seller across town. I did not pay any tax in MA. States that do not charge a sales tax include New.

You might escape sales tax if you buy from smaller merchants who dont collect tax. I live in NH I bought my car in Massachusetts as it was considerably cheaper than in NH for the car I was looking for. You can only avoid.

Moving states before buying a new car to avoid sales tax. The states that charge zero sales tax on vehicle transactions are Alaska Delaware Montana New Hampshire and Oregon. However if you live in neighboring Vermont Maine or Massachusetts you cannot simply go to New Hampshire to buy a car to avoid paying sales tax.

Five states charge no sales tax at all when you buy a car. The website will tell you or will add the tax when you check out. First theres always the option to buy a car in another state to avoid sales tax.

There are ways to avoid paying sales taxes on cars buying used or new but the options might not work for you. Exclusive Savings on All GMC Car Models. Probably the simplest way of avoiding sales taxes on a boat purchase is to buy the boat in a state that doesnt have a sales tax.

But you cannot drive back to NH once you buy. Try Smaller Websites and eBay Merchants. If you bought a car from a dealership they will likely collect sales tax and pass it along to the proper agency in your state.

Montana Alaska Delaware Oregon and New Hampshire. Only five states do not have statewide sales taxes. However you will have to pay the tax when you register the vehicle back in your home state anyway.

Taxes I am currently looking at purchasing a 25000-30000 car MA sales tax on this vehicle would be about 2000. States that do not charge a sales tax include New Hampshire Oregon Delaware Montana and Alaska. However you will need to pay sales tax in your state of residence.

As long as you are a resident of New Hampshire you wont need to pay sales tax on the purchase of your car even when you go to register it. Weve done our best to cover everything you need to know about buying and selling vehicles in New Hampshire. So if you live in one of them you could be in for an excellent deal.

Youll still need to pay dealer fees and registration but you can save thousands of dollars on sales tax when you register a vehicle in New HampshireKeep in mind that where you bought the vehicle will not determine the sales tax but rather the state. The state where you pay vehicle registration fees is the one that charges the sales tax not the state where you made the vehicle purchase. Alaska also has no state sales tax but municipal sales taxes add an average of a little under 2 percent.

Get Connected to Trusted Local Dealers. Six of Montanas 56 counties do not collect a local option vehicle tax. These include Montana New Hampshire Delaware and Oregon.

New Hampshire is often touted as one of the best places to buy and own a car thanks to its car sales tax rate. Get Free Quotes Now. Find Local GMC Dealers.

Big Horn Deer Lodge Flathead Granite Phillips and Richland. You may also have. Answer 1 of 6.

This is tax evasion and authorities are cracking down on. What Are Some Loopholes to Avoid Paying Sales Tax on Cars.

Which States Charge The Most In Dealer Doc Fees Carvana Blog

Study Reveals Colorado S Most Overpriced Used Car Fox31 Denver

Cheapest State To Buy A Car Your Guide To Buying Cars From Out Of State

Dealer Fees Which Ones Should I Pay Find The Best Car Price

Cheapest State To Buy A Car Your Guide To Buying Cars From Out Of State

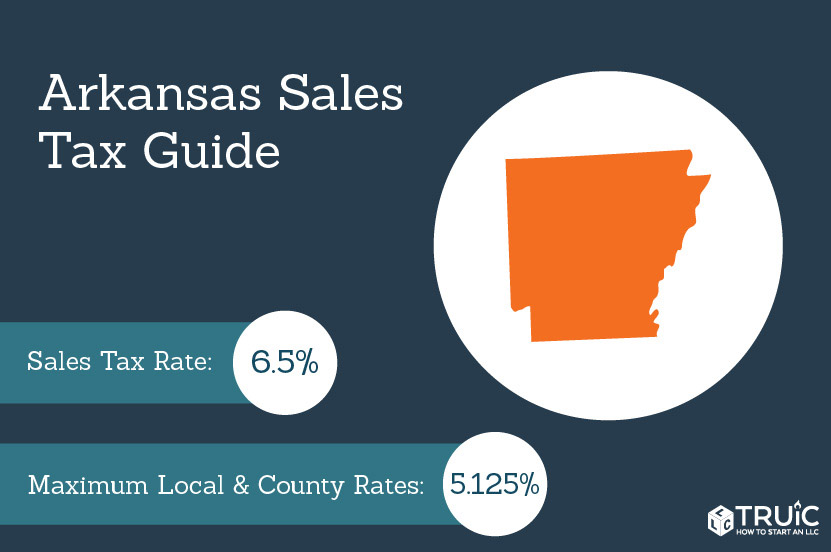

Arkansas Sales Tax Small Business Guide Truic

Indiana Sales Tax On Cars What Should I Pay Indy Auto Man Indianapolis

Dealer Fees Which Ones Should I Pay Find The Best Car Price

Buying A Car In Florida From Out Of State

Which States Charge The Most In Dealer Doc Fees Carvana Blog

New Hampshire Vehicle Sales Tax Fees Find The Best Car Price

Dealer Fees Which Ones Should I Pay Find The Best Car Price

New Hampshire Vehicle Sales Tax Fees Find The Best Car Price

New Hampshire Vehicle Sales Tax Fees Find The Best Car Price

New Hampshire Vehicle Sales Tax Fees Find The Best Car Price

New Subaru Legacy For Sale In Saint J Vt Saint J Subaru

Cheapest State To Buy A Car Your Guide To Buying Cars From Out Of State

The Best Spots For Tax Free Shopping In New Hampshire

Cheapest State To Buy A Car Your Guide To Buying Cars From Out Of State